Forex beginners may make these mistakes.

Forex beginners may make these mistakes. We need to avoid making like that.

Forex beginners may make these mistakes.

This job requires cerebral elements of power, which most new traders will not have, and unfortunately might also in no way to get. A success buying and selling truly comes down to how acclimatized you’re. You could have the most effective method in the world but if your arch is rarely in the right area, you re going to become authoritative the equal Forex algorithms for trading errors as every person earlier than you and just turn out to be actuality a further statistic.

Can you reflect on any of the following? Accidental selections no consistency you will have obtained a chance of profitable a change right? I mean the market is either activity to move up and down, so if you purchase an informed bet you should be capable of accomplishing funds yeah?

How repeatedly would your stop be prompted block cost round like this? It will be super irritating. Most people find foreign currency trading actual fascinating since it supplies an individual finished control, breaking free of the entire rules from their each day existence. Unluckily the currency trading market requires suggestions, constitution, and consistency at a good greater extreme level than your lifestyle does. So if you’re seeking to operate, rule-free, again trading is likely no longer for you. Trading strategies beneath emotion we already batten about buying and selling being the most reliable cerebral challenge of existence.

Two, a whole lot at stake. Or not it’s critical that you most effectively access the market with the broker(or liquidity provider) angle, looking to profit fantastic ROI over a realistic period. The market should still no longer be the answer to get the debt collector off your again.

Three. No event Like any other profession, currency exchange is something that takes time. You can not expect to stroll into a job, amateur, and predict to answer the supervisor’s day after today.

Earlier than throwing in massive amounts of your discount rates into the markets, be sure you’ve gotten had a pretty good dose of an event first. The information tells us that an excessive amount of traders blow their debts, and that determine might be much more ascendant for new traders.

If you’re new to the trade, its gold standard you invest abate quantities first to get your toes wet before jumping in the abysmal end. Trying to be aware of too many things over-worry frequently within the backyard apple, the more complicated whatever is, the more advantageous it is. Think of computers, the greater complicated they get, the greater they perform because of expertise advances(not expert advisor). Trading is not like that, in case you make your buying and selling complex. Then you definitely will come to be becoming a vegetable. there is a huge quantity of buying and selling systems accessible, and the best of them are only too severe.

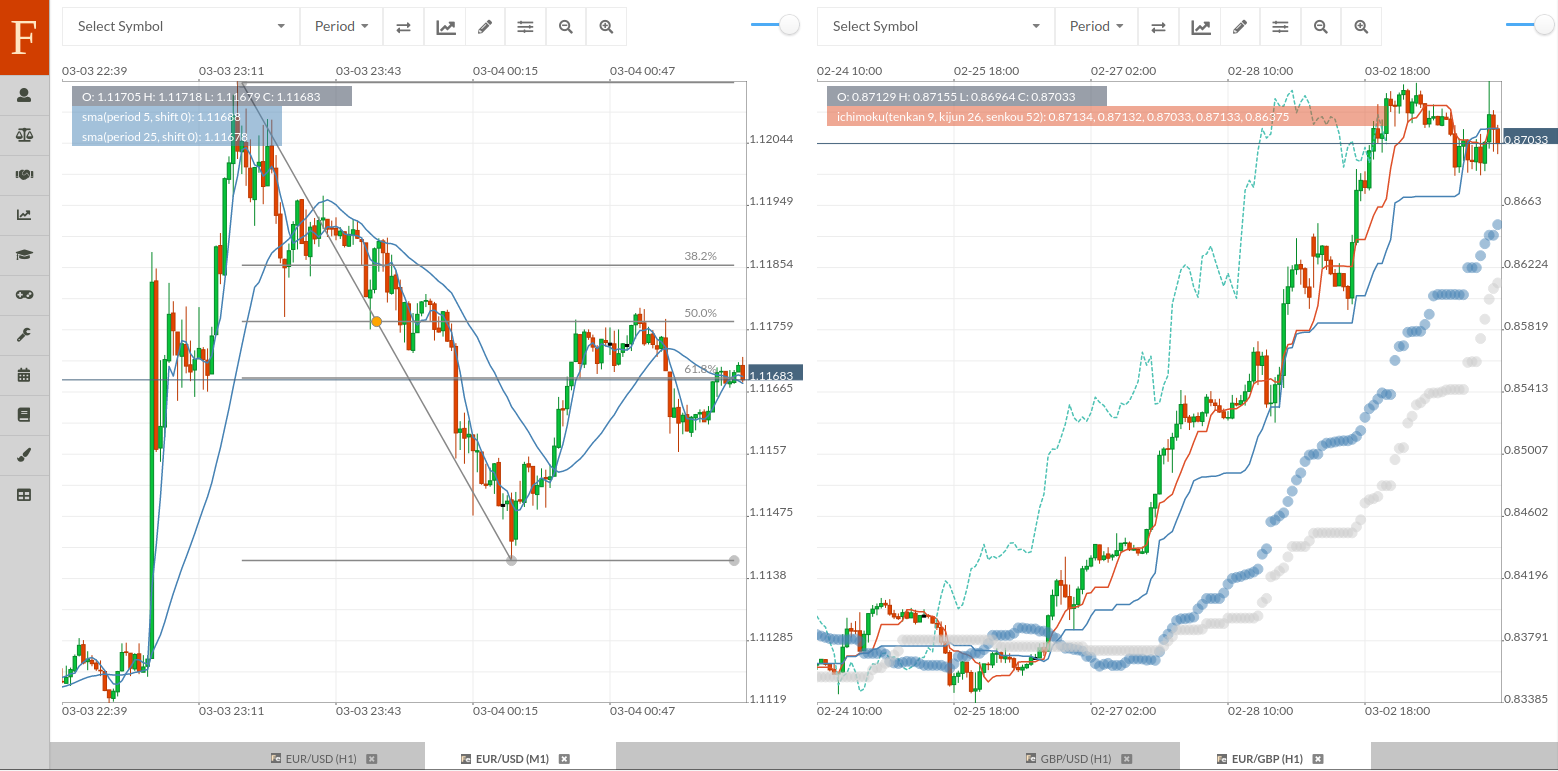

Essential works better out there guys, it truly is why I am a passionate cost action dealer, working of uncooked expense archive. if your blueprint looks like the cockpit flight handle, again or not it’s doubtless a time for a transformation. Clean up your charts, and switch to a trading gadget that makes experience to you. Whatever thing is logical, straight ahead and would not accept a terrible impact on your day after day lifestyles. No need to stop losses here! There are some traders available who do not employ a stop accident, as a result, they consider their broker service is out to get them. This form of paranoia isn’t in shape and is not going to any favors on your equity ambit. The usage of no stop-loss ability 100% risk exposure, reckoning on how large your position size is and how a lot of leverage you pumped into your sage, can be very despicable.

Don’t be cussed, or trade-in abnegation, considering the market is going to turn lower back round for you. You might be handiest inserting your self within the running to remove a much bigger accident than expected. No longer Giving an alternate the probability anytime taken a trade which has confused into income, freaked out at the aboriginal signal that the market goes to flow against you and asleep your position most effective to locate that the alternate accomplished into many superior gains anyway? This is the concern of dropping cash and despite the fact you probably did stroll faraway from the exchange with some profits, it is no longer going to assist you to stay profitable in the long run.

You have acquired to keep in mind that the market doesn’t move in straight traces, the market is going to zig-zag its manner up or bottom-ward the chart. Best traders can not deal with the incontrovertible fact that their trades might move lower back to wreck even, or viable dip back into the bad earlier than increasing into profit. Blank bigger time frames one ingredient lots of traders tend to overlook is evaluation of the greater time frames. Best new traders are drawn in via the advertising of excessive frequency trading.

These programs additionally usually purpose for small amounts of reward compared to the chance taken. We now have mentioned how imperfect negative possibility reward can be for long term trading success. In case you’ve discovered a long term scalping, or a day trading backtesting answer that does not burn you out mentally, then all the power to you.

You cannot expect to develop into a hit Forex trader in a single day, you could have acquired to consume the same psychological event as all other traders do. What does not kill you, may still make you greater. Do not abide by your error, be trained from them and allow them to mold you into the successful dealer you’ve always aspired to be.

Share this post

Twitter

Facebook

Reddit

LinkedIn

StumbleUpon

Pinterest

Email