Funds Management (3) - PlaygroundFX

This topic discusses a kind of misunderstanding about the requirements for funds management. Let us find the best trading strategy at PlaygroundFX.

A Kind of Misunderstanding about the Requirements for funds management (3)

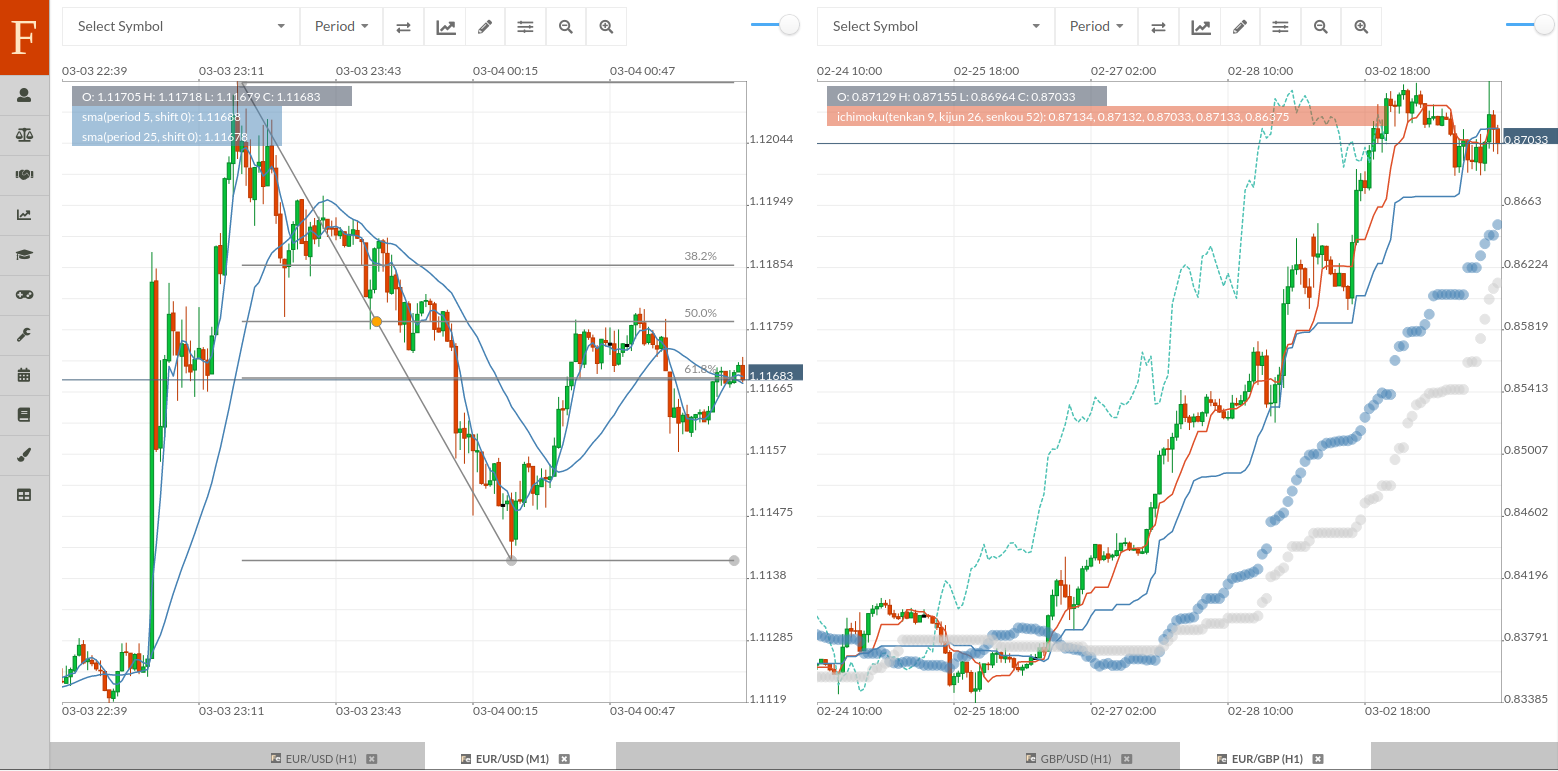

We prefer to use Fintechee as our trading terminal.

Most traders bet their funds in a range of a couple of hundred USD up to 10,000 USD. If they come along with the strategy of Martingale and trade under a market movement not satisfying their desires, obviously the funds are not enough.

How much do they need to prepare for running a Martingale EA?

Let’s calculate further. For example, you bet from an initial position of 1000 units of some instrument against USD and the market movement goes against the orientation that you bet, you add more funds and every time the funds are as double as the funds you bet previously.

- The first time, you bet 1000 units to go long, so if the market movement goes down and the position gets a loss, you lose 0.1 USD per pip.

- When the market movement goes down to 20 pips below the point that you entered, you have a position with 2 USD loss and add the position of 2000 units, then, if the market movement doesn’t reverse, you will lose 0.3 USD pep pip.

- When the market movement goes down to more 20 pips below the point that you entered the first time, you have a position with 8 USD (2 + 0.3 x 20) loss and add the position of 4000 units, then, if the market movement doesn’t reverse, you will lose 0.7 USD per pip.

- The numbers are not that big, right? Then if the market movement always goes down and the loop runs for 20 times, how much has been lost and how much is the bet now for per pip?

- You can see, just 20 rounds after the market movement insists on the orientation against your position, the loss will be more than $4M. I think most of the traders with a small number of funds can’t resist just 10 rounds and get a margin call.

Share this post

Twitter

Facebook

Reddit

LinkedIn

StumbleUpon

Pinterest

Email