Forex Broker Regulation - PlaygroundFX

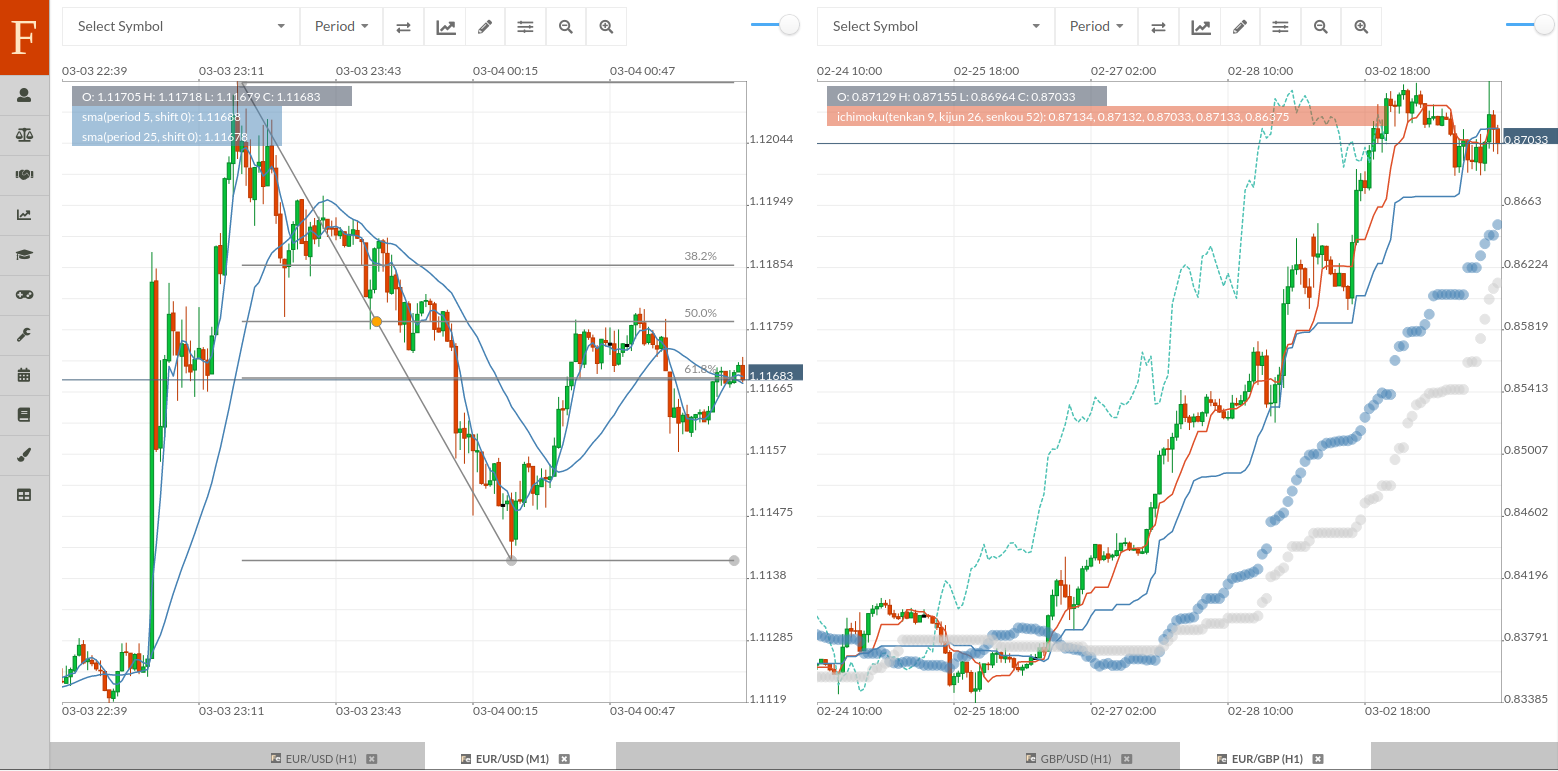

Forex broker regulation is one of the main topics of PlaygroundFX. Let us find the best trading strategy for Forex beginners by using Fintechee.

Forex Broker Regulation

Forex trading can be lucrative profits circulate if performed correctly, but there are lots of things one should be aware of before delving into this industry.

One of the crucial arch concerns when choosing the right Forex broker is to have in mind the regulation s that administer them.

Forex broker s will operate under regulation s – each of which varies about how these brokers work together with your cash.

In Africa, native foreign exchange brokers are regulated by the financial sector to conduct. However, Forex merchants can select brokers regulated foreign places or now not adapted in any respect which can be a risky option as mentioned under.

We provided some insights into the main regulators that govern probably the most universal Forex broker s that African traders choose.

FSCA – Forex Broker Regulation of South Africa

The FSCA is the native regulator it is most likely to be encountered by way of South African Forex merchants.

Brokers whose abatement under these rules ought to have a local presence with a native office and at least one director living in South Africa, knowledgeable indemnity insurance is also required.

ASIC – Forex Broker Regulation of Australia

Australian Forex trading brokers regulated by means of ASIC are an additional established choice Forex merchants. These consist of Forex brokers from Pepperstone, IC Markets, and AxiTrader. (Data gathered by Fintechee)

Australian Forex broker s accept powerful popularity because of ASIC requirements together with the claim to segregate customers’ deposits and offer training stages, as well as reporting requirements.

In further regulation adjustments are expected that might also impact advantage, joining bonuses and more as mentioned during this ABC commodity.

FCA – Forex Broker Regulation of The United Kingdom

The UK Forex broker s have historically been accepted traders but as a result of European Union restrictions, the FCA has activated strict guidelines on corporations in contemporary years. The main restriction comprises an optimum advantage.

You could read the complete record of FCA restrictions with two other key components that merchants’ positions are bankrupt out when their dollars fall to % of the allowance mandatory to keep their open positions, and prevention of traders having a terrible steadiness.

No Regulations

A few new gamers in the Forex broking service market, including Hugosway, don’t seem to be ruled via any laws. This potential they could present unlimited leverage and offer promotional bonuses and other merits that at face value may accomplish them attractive to Forex merchants.

Selecting such brokers may also be incredibly risky. There aren‘t any safeguards with these brokers and many historic Forex scams were linked to able brokers.

It is suggested not to choose such brokers.

What Forex broker regulation is right for you?

Traders should still opt for a Forex broker that is regulated.

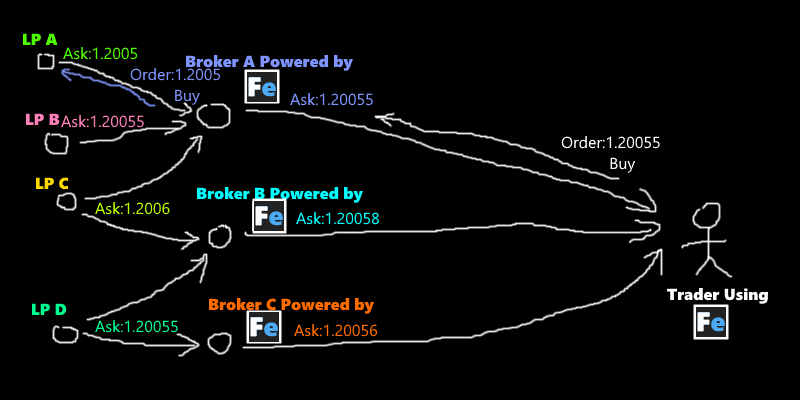

You may discover such brokers through activity to every regulator’s website or by visiting Fintechee – which has adapted Forex broking service lists.

These lists are aggregated for a large number of areas – from South Africa to Singapore – and focus on key classes from spreads and Forex trading systems to excessive leverage Forex broker s.

It is crucial to notice that Forex trading involving advantage incorporates an excessive stage of risk. Traders should still take into account these risks – such as losses beyond your deposit – ahead of starting off trading and may consider free tools equivalent to demo money owed to see if CFDs are right for you.

Share this post

Twitter

Facebook

Reddit

LinkedIn

StumbleUpon

Pinterest

Email